Loading

Get Form 1065n, 2009 Partnership Return Of Income, With - Nebraska ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

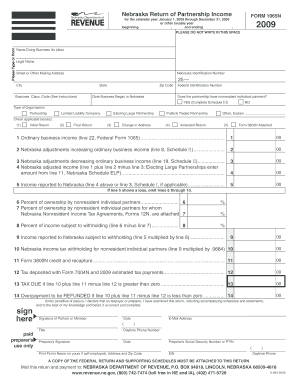

How to fill out the Form 1065N, 2009 Partnership Return of Income, with Nebraska online

Filling out the Form 1065N is an important step for partnerships operating in Nebraska. This guide provides a comprehensive overview of the necessary steps to complete this form online, ensuring accuracy and compliance with state regulations.

Follow the steps to effectively complete your Form 1065N online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- Enter the legal name and the name doing business as (dba) in the designated fields of the form. Ensure that the information is accurate and matches your partnership's official documents.

- Provide the mailing address, including street address, city, state, and zip code. Make sure to include the Nebraska Identification Number and the Federal Identification Number, which are essential for processing your return.

- Indicate the date the business began in Nebraska. This information helps determine your partnership's eligibility and filing requirements.

- Answer whether the partnership has nonresident individual partners. If 'yes', complete Schedule III as instructed.

- Select the type of organization by checking the applicable box indicating whether your partnership is a general partnership, limited liability company, or other specified type.

- Check any applicable boxes for the return specifics, such as whether it is an initial return, final return, change of address, or amended return.

- Fill in the financial information in the designated lines, providing figures for ordinary business income, Nebraska adjustments, and any tax withholding details according to the provided instructions.

- Complete the tax calculation sections, ensuring all income subject to withholding is accurately reported as well as any credits or payments already made.

- Once all sections are filled out correctly, review your entries for accuracy. You can then save changes, download, print, or share the completed form as necessary.

Complete your Form 1065N online today to ensure timely filing and compliance with Nebraska tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.