Loading

Get Application For Automatic Extension Of Time Gr-4868

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Automatic Extension Of Time GR-4868 online

Filling out the Application For Automatic Extension Of Time GR-4868 online can seem daunting, but with clear guidance, you can successfully complete this process. This guide will provide you with step-by-step instructions to navigate through the form effectively.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

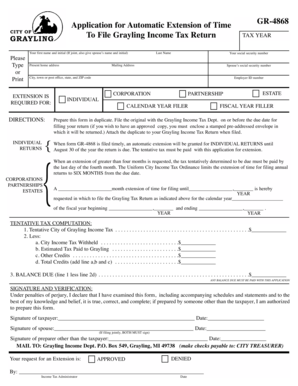

- Begin by filling in your first name and initial. If you're filing jointly, also include your spouse’s name and initial. Remember to type or print clearly for legibility.

- Provide your present home address, ensuring that you include the city, town or post office, state, and ZIP code.

- Select the type of return you are filing. Mark whether it is an individual return, corporation, partnership, or estate.

- Indicate the tax year for which you are requesting an extension. This will typically be the current year.

- Enter your social security number along with your spouse’s social security number, if applicable.

- Complete the section on necessities for the extension. Specify the length of time requested and the date by which you wish to file the return.

- Input the tentative tax computation by listing the tentative city of Grayling income tax amount and any applicable credits.

- Calculate the balance due by deducting total credits from the tentative tax and ensure that any balance due is paid with your application.

- Sign and date the form. If filing jointly, both you and your spouse must provide your signatures. If someone else prepared your application, include their name and signature as well.

- Once you have completed the form, review all fields for accuracy before saving your changes, downloading, printing, or sharing the document as required.

Complete your Application For Automatic Extension Of Time GR-4868 online today for a smooth filing experience.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.