Loading

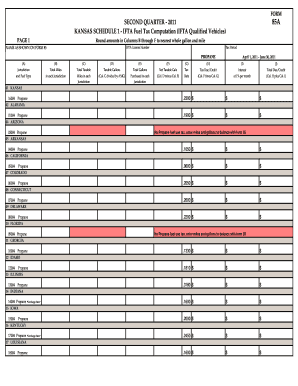

Get 85a - Second Quarter Propane Form - Kansas Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 85A - Second Quarter Propane Form - Kansas Department Of Revenue online

Filling out the 85A - Second Quarter Propane Form from the Kansas Department of Revenue is a crucial step for managing propane fuel tax computations. This guide will walk you through each section and field of the form, ensuring a smooth and efficient online submission process.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your IFTA License Number in the designated field at the top of the form. This is essential for tracking your fuel tax obligations.

- In the field labeled 'Name as shown on Form 85', provide the name exactly as it appears on the initial form to maintain consistency and avoid any discrepancies.

- Specify the tax period for the form, which is from April 1, 2011, to June 30, 2011, in the relevant section.

- For each jurisdiction listed, fill in the 'Total Miles' driven. This is the total distance traveled in each respective jurisdiction during the stated tax period.

- Next, enter the 'Total Taxable Miles' in the corresponding field for each jurisdiction to determine the miles for which taxes will be calculated.

- Input the 'Taxable Gallons' used in each jurisdiction based on your fuel usage records. Ensure these reflect actual usage.

- Fill in the 'Total Gallons' purchased in each jurisdiction. This will help in calculating any refunds or taxes owed.

- Calculate 'Net Taxable Gals' by subtracting any non-taxable gallons from the total gallons purchased.

- Apply the tax rates shown to compute the 'Tax Due' for each jurisdiction. This is generally a calculation involving the net taxable gallons.

- Include any interest accrued on late filings in the 'Interest' field, following the relevant guidelines.

- Finally, tally the 'Total Due/Credit' by adding together the totals from the tax and interest fields.

- After completing all sections, review the form carefully for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your 85A - Second Quarter Propane Form online today to ensure accurate fuel tax reporting.

This begins by filling out an electronic return form (ERF) which will require information such as miles traveled within each jurisdiction, fuel gallons purchased, and other fuel mileage information related to the previous quarter. The ERF will then calculate the amount of taxes to pay with your quarterly tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.