Loading

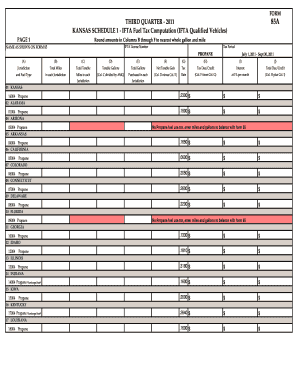

Get Round Amounts In Columns B Through F To Nearest Whole Gallon And Mile

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Round Amounts In Columns B Through F To Nearest Whole Gallon And Mile online

This guide provides clear instructions for filling out the Round Amounts In Columns B Through F To Nearest Whole Gallon And Mile form online. Following these steps will help ensure accurate data entry and compliance with tax regulations.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your IFTA license number in the designated field at the top of the form.

- Write your name as shown on Form 85 in the corresponding section.

- Indicate the tax period, specifying the dates which in this case is July 1, 2011 - September 30, 2011.

- Move to Column B, where you will enter the total miles traveled in each jurisdiction, rounding to the nearest whole mile.

- In Column C, input the total taxable miles, ensuring to round to the nearest whole mile as well.

- Next, in Column D, you will record the taxable gallons used, rounding to the nearest whole gallon.

- In Column E, enter the total gallons purchased, rounding these numbers to the nearest whole gallon.

- Proceed to Column F to determine the net taxable gallons, which is the result of Column D minus Column E, rounded to the nearest whole gallon.

- Fill in Columns G through J with the appropriate tax rates and calculations, according to the entries made in previous columns.

- Review all entries for accuracy, ensuring that totals from columns match those required on the front of your return.

- Once all sections are completed and verified, save your changes, and choose to download, print, or share the finalized form as needed.

Start completing your IFTA form online today to stay compliant.

To calculate IFTA tax for fuel tax reporting you'll need to calculate: Total miles driven in each state/province X ÷ Overall fuel mileage = Fuel consumed in each state/province X. Fuel tax required in each state/province X – Fuel tax paid in each state/province X = Fuel tax still owed to each state/province.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.