Loading

Get Withdrawal Benefit - State Of Delaware - Office Of Pensions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Withdrawal Benefit - State Of Delaware - Office Of Pensions online

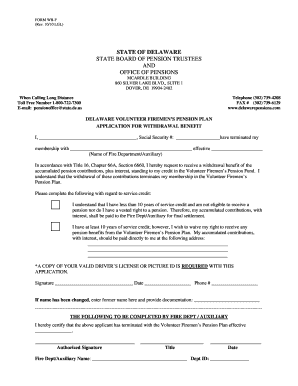

This guide provides a clear and supportive approach to filling out the Withdrawal Benefit form from the State of Delaware Office of Pensions. Users can follow these detailed instructions to ensure their submissions are completed correctly and efficiently.

Follow the steps to complete the form online with ease.

- Press the ‘Get Form’ button to obtain the Withdrawal Benefit form and open it for completion.

- Begin the form by entering your full name in the designated section, ensuring you input it as it appears on your identification documents.

- In the next field, provide your Social Security number to help verify your identity.

- Specify the name of the fire department or auxiliary from which you have terminated your membership, along with the effective termination date.

- Indicate your understanding of your service credit status by checking the appropriate box. If you have less than 10 years of service credit, acknowledge that you are not eligible for pension benefits.

- If you have at least 10 years of service credit and wish to waive pension benefits, provide your current address where your accumulated contributions should be mailed.

- Attach a copy of your valid driver's license or a picture ID to the application to verify your identity.

- Complete the signature section by signing your name, adding the date, and providing your phone number.

- If you have changed your name, remember to provide your former name and any necessary documentation.

- Lastly, ensure that the authorized representative from your fire department or auxiliary fills out their section of the form, including their signature, title, date, and department identification.

- Once all sections are completed accurately, you can save changes, download, print, or share the form as needed.

Complete your Withdrawal Benefit form online today to ensure a smooth processing experience.

A withdrawal credit in a pension plan refers to the portion of an employee's retirement assets in a qualified pension plan that the employee is entitled to withdraw when they leave a job. Under most pension plans, both the employer and employee make periodic contributions to a fund shared by all eligible employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.