Loading

Get Community Bank And Credit Union Initiative Credit Union Investment ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Community Bank and Credit Union Initiative Credit Union Investment agreement online

Filling out the Community Bank and Credit Union Initiative Credit Union Investment agreement online can be straightforward with the right guidance. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the agreement form successfully.

- Click ‘Get Form’ button to access the agreement form and open it in your preferred online document platform.

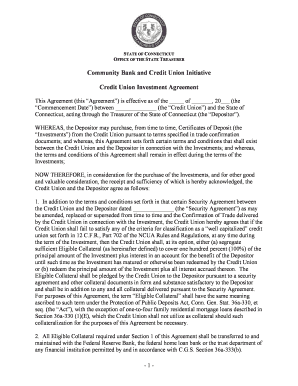

- Locate the Commencement Date field. Enter the effective date of the agreement as the first step in filling out the form.

- In the next section, input the name of the Credit Union in the designated space. Ensure it is spelled correctly to avoid any inconsistencies.

- Proceed to read through the terms set out in the agreement. Take special note of the sections regarding the classifications of Credit Unions and Eligible Collateral, ensuring you understand the obligations.

- Next, complete any required fields related to security agreements and representations. Confirm that you have the authority to enter into this agreement on behalf of the Credit Union.

- Provide details regarding insurance policies if applicable, as well as the Federal Reserve Bank or other financial institution where the Eligible Collateral will be held.

- Review Exhibit A, ensuring that the representatives of the Depositor are accurately listed, and input any necessary investment directions.

- Once all fields are completed, double-check for accuracy and completeness before submitting. You can save your changes, download, print, or share the final agreement as needed.

Complete your Community Bank and Credit Union Initiative Credit Union Investment agreement online today.

Because credit unions are nonprofit organizations, they are able to offer higher interest rate returns to its members on their savings or checking accounts. They are also able to offer business or home loans to members who wouldn't normally qualify at a traditional bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.