Loading

Get Irs Schedule M-1 And M-2 (1120-f Form)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Schedule M-1 And M-2 (1120-F Form) online

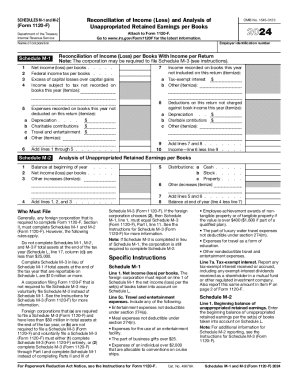

Filling out the IRS Schedule M-1 and M-2 forms can be an essential part of managing a foreign corporation's income reporting. This guide will provide a clear, step-by-step method of completing these forms online, ensuring that you understand each component and its requirements.

Follow the steps to successfully complete Schedule M-1 and M-2 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Schedule M-1, where you will reconcile your book income with the income reported on your tax return. Enter the net income or loss per your books on line 1.

- On line 5, list any expenses recorded on the books that are not deducted on this return. Make sure to break these down into categories, such as depreciation and charitable contributions.

- Prepare the following items under lines 7 and 8 by itemizing income and deductions that affect your taxable income. Pay attention to tax-exempt interest and other unique items that should be recorded.

- Complete Schedule M-2 by entering the balance of unappropriated retained earnings at the beginning of the year on line 1, and include any net income or loss for the year.

- Ensure all lines are filled accurately, and review the amounts reported in both schedules to verify consistency with the overall income reported.

- Once all entries are completed, you can save changes, download the form, or print it for your records.

Take control of your compliance today by filling out your IRS forms online.

Schedule M-2 is divided into four columns and is used to reconcile the accounts that affect a shareholder's basis. Column (a) is for the Accumulated Adjustments Account (AAA). Column (b) is for shareholders' undistributed taxable income previously taxed. Column (c) is for accumulated earnings and profits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.