Loading

Get Irs 1040 - Schedule 8812 (sp) 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule 8812 (SP) online

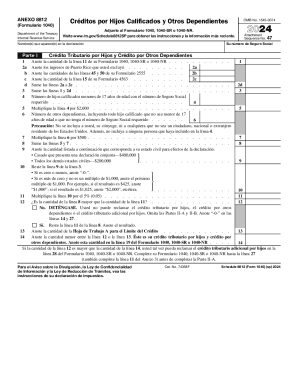

Filling out the IRS 1040 - Schedule 8812 (SP) is essential for claiming child credits and other dependent credits on your tax return. This guide provides clear and structured steps on completing the form online, ensuring you understand each section and can maximize your credits.

Follow the steps to complete your form effectively.

- Click ‘Get Form’ button to access the Schedule 8812 (SP) and open it in your editor.

- Begin by entering your social security number and the names as they appear on the tax return. This information is critical for identification.

- In Part I, you will enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR. Follow this by listing any excluded income from Puerto Rico.

- Summarize the amounts from lines 2a to 2c, and then total lines 1 and 2d.

- Enter the number of qualifying children under the age of 17 with valid social security numbers and multiply that number by $2,000.

- List the number of other dependents, excluding those counted in line 4, and multiply that total by $500.

- Combine the results from lines 5 and 7 to determine your credit amount.

- Refer to the marital status limits to properly adjust your credit based on whether you are married filing jointly or not.

- From line 3, subtract the amount from line 9, ensuring to follow the specific instructions for rounding if necessary.

- Determine if further steps in Part II-A or II-B are applicable by checking if your amounts allow for additional claims.

- When finished, you have the option to save your changes, download the completed form, print it for your records, or share it as needed.

Start completing your documents online to ensure you claim all eligible tax credits.

How to claim this credit. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.