Loading

Get Application For Master Policy - Calhfa Mis 2.doc - Calhfa Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Master Policy - CalHFA MIS 2.doc - Calhfa Ca online

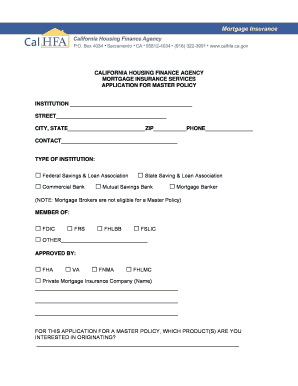

Navigating paperwork can be challenging, but filling out the Application For Master Policy with CalHFA is a structured process. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to access the Application For Master Policy and open it in your editor.

- Fill in the institution name at the top of the form in the designated field.

- Complete the street address, city, state, zip code, and phone number fields with your institution's information.

- Select the type of institution by checking the appropriate box, ensuring the designation aligns with your organization.

- Indicate your institution's membership status by checking any relevant boxes (FDIC, FRS, etc.) and provide additional details where necessary.

- List any approvals your institution has by checking the relevant boxes and providing the name of the private mortgage insurance company, if applicable.

- State which products you are interested in originating under the master policy in the specified area.

- Answer whether your institution will service the loans originated under this master policy. If not, specify the institutions to which servicing will be transferred.

- Gather the required documentation, including audited financial statements, underwriting guidelines, organizational chart, and a list of originating offices.

- Submit the completed form along with the necessary documents to the specified address, ensuring everything is accurate before sending.

- After submission, await further instructions if additional information is needed or if an on-site visit will be required.

- Once all steps are completed, you can save the form, download it, print a copy, or share it as needed.

Complete your documents online today to ensure a smooth application process.

Many online lenders can approve your loan application and send funds within a couple of days, while banks and credit unions may take up to a week. Lenders will consider your credit score, income and debt during the loan approval process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.