Loading

Get 2009 Schedule G-1 -- Tax On Lump-sum Distributions. 2009 California Schedule G-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Schedule G-1 -- Tax On Lump-Sum Distributions online

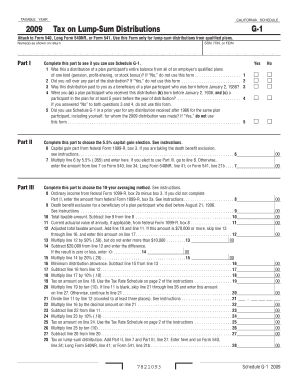

Filling out the 2009 Schedule G-1 is essential for anyone who received a lump-sum distribution from a qualified retirement plan. This guide provides a step-by-step approach to ensure that you accurately complete the form online.

Follow the steps to successfully complete the 2009 Schedule G-1.

- Press the ‘Get Form’ button to access the 2009 Schedule G-1 and open it in your preferred form editor.

- Fill out the name(s) and Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Federal Employer Identification Number (FEIN) at the top of the form as shown on your return.

- Complete Part I by answering the eligibility questions. Ensure that you confirm whether the distribution was the entire balance from the employer’s qualified plans and if you rolled over any part of the distribution. If you answer 'No' to these questions, do not use this form.

- Proceed to Part II if eligible, where you will determine if you are choosing the 5.5% capital gain election. Enter the capital gain part from federal Form 1099-R, box 3, if applicable.

- Multiply the amount from line 6 by 5.5% and enter the result on line 7. This amount is crucial for your tax calculations on Form 540 or other related forms.

- If you are taking the 10-year averaging method, move to Part III. Enter the ordinary income from federal Form 1099-R, box 2a minus box 3 on line 8.

- Fill out the other lines in Part III as specified, including death benefit exclusion and total taxable amount calculations. Ensure to follow the instructions closely for lines 10 through 28.

- Once you have completed all sections, review the information for accuracy. Save any changes made to the document.

- Download, print, or share the completed form as needed to attach it to your Form 540, Long Form 540NR, or Form 541.

Start filling out your 2009 Schedule G-1 online today for a smoother tax filing experience!

When it's time to prepare tax returns, distributions show up in two important places: On the business side, distributions show up on the balance sheet section of your tax return (total distributions since the business started) and in Section M-1, which shows distributions that have been made throughout the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.