Loading

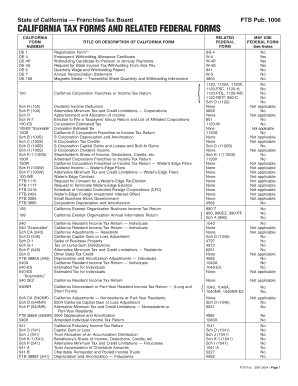

Get 2004 California Tax Forms And Related Federal Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 California tax forms and related federal forms online

Filling out tax forms can seem daunting, but with a clear process, you can complete the 2004 California tax forms and related federal forms efficiently online. This guide provides step-by-step instructions to help you navigate the forms with confidence.

Follow the steps to fill out your tax forms accurately online.

- Click the ‘Get Form’ button to access the forms you need. This will allow you to open the forms online in the appropriate editor.

- Identify the specific form or schedule relevant to your tax situation from the list provided, such as California form 540 for individual income tax or form 100 for corporations.

- Begin filling out the form by entering your personal information, including your name, address, and social security number. Ensure all information is correct to avoid delays.

- Proceed to the income section of the form. Report all sources of income accurately, including wages, dividends, and any other income types. Be sure to refer to any related federal forms as needed.

- Move on to the deductions and credits sections. Identify any deductions you qualify for, which may reduce your overall tax liability. Consult the guidelines to ensure eligibility.

- Calculate your total tax owed or any refund expected based on the completed sections. Review the calculations carefully for accuracy.

- After completing the form, check for any necessary signatures or additional documentation that needs to be attached. Make sure all required fields are filled out before proceeding.

- Save your completed form. You may download, print, or share the form as necessary. Ensure you keep a copy for your records.

Start filling out your 2004 California tax forms and related federal forms online today for a smoother tax filing experience.

You may request a waiver of the penalty if either one of the following apply: You underpaid an estimated tax installment due to a casualty, disaster, or other unusual circumstance and it would be against equity and good conscience to impose the penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.