Loading

Get Wi Dor Schedule H-ez 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

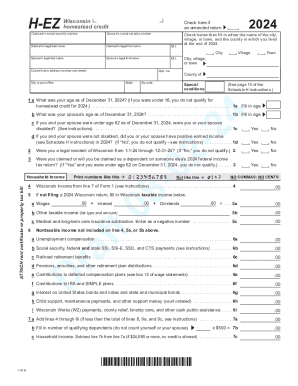

How to fill out the WI DoR Schedule H-EZ online

Filling out the WI DoR Schedule H-EZ online is an essential step for individuals seeking the homestead credit in Wisconsin. This guide provides clear and supportive instructions for users at all experience levels to help them successfully complete the form.

Follow the steps to complete the WI DoR Schedule H-EZ online.

- Click ‘Get Form’ button to download the form and open it for editing.

- Enter the claimant’s social security number in the designated field.

- Fill out the claimant's legal name, including first name, middle initial, and last name.

- Provide the spouse’s social security number, if applicable, along with their legal name.

- Indicate your place of residence at the end of 2024 by specifying the city, village, or town and county.

- Fill in special conditions according to the guidance on page 10 of the Schedule H instructions.

- Answer the questions regarding age, residency in Wisconsin, and dependency status, providing the appropriate responses.

- Report your Wisconsin income and any additional taxable income, making sure to follow the instructions for each line.

- Detail any nontaxable income and complete the necessary calculations as directed.

- Complete the household income section, ensuring all calculations are accurate and follow the guidelines provided.

- Outline your property taxes or rent in the subsequent section, attaching relevant documents as needed.

- Calculate the homestead credit, utilizing the appropriate figures and tables referenced in the instructions.

- Sign the form with the claimant’s and spouse’s signatures and include the date along with contact numbers.

- Once completed, save your changes, and choose to download, print, or share the form as necessary.

Complete your documents online with ease by following these steps.

Renter's and Homeowner's School Property Tax Credit: Available if you paid rent during 2023 for living quarters that was used as your primary residence OR you paid property taxes on your home. Not available if you or your spouse claims the veterans and surviving spouses property credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.