Loading

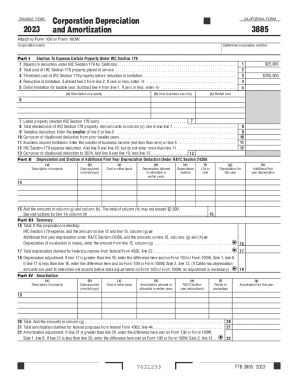

Get 2023 Form 3885 Corporation Depreciation And Amortization. 2023 Form 3885 Corporation Depreciation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Form 3885 Corporation Depreciation and Amortization online

The 2023 Form 3885 Corporation Depreciation and Amortization is essential for corporations to report their depreciation and amortization expenses. Filling out this form accurately is crucial to ensure proper tax compliance and benefit from potential deductions.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter the corporation name and California corporation number at the top of the form.

- In Part I, complete the election to expense certain property under IRC Section 179. Fill in the maximum deduction allowable for California.

- Provide the total cost of IRC Section 179 property placed in service during the taxable year.

- State the threshold cost of IRC Section 179 property before any reduction in limitation.

- Calculate the reduction in limitation by subtracting line 3 from line 2. If the result is zero or less, enter -0-.

- Determine the dollar limitation for the taxable year by subtracting the reduction from the maximum deduction. Enter -0- if the result is zero or less.

- Describe any property and list the costs associated with it for business use in the provided sections.

- Sum the elected cost of IRC Section 179 property to arrive at the total elected cost.

- Calculate the tentative deduction by entering the smaller amount between the dollar limitation and the elected cost.

- Include any carryover of disallowed deduction from prior years and assess the business income limitation.

- Calculate the IRC Section 179 expense deduction, ensuring not to exceed the business income limit.

- Complete Part II by detailing the depreciation claimed along with any additional first year depreciation options.

- Summarize total depreciation claimed for federal purposes and any necessary adjustments.

- Complete Part IV for amortization details, including a description of property and associated costs.

- After filling out all sections, review for completeness and accuracy. Save your changes, then download, print, or share the form as needed.

Complete your documents online for efficiency and accuracy.

A. Purpose. Use form FTB 3885A, Depreciation and Amortization Adjustments, only if there is a difference between the amount of depreciation and amortization allowed as a deduction using California law and the amount allowed using federal law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.