Loading

Get Tr-579-wt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TR-579-WT online

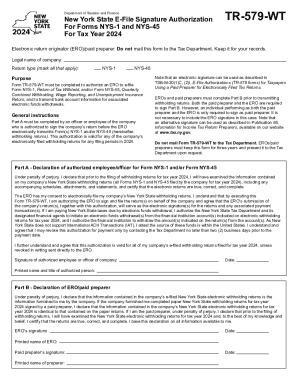

Completing the TR-579-WT form is essential for authorizing an electronic return originator to e-file New York State withholding returns. This guide provides clear and detailed steps to help you navigate the process efficiently.

Follow the steps to complete the TR-579-WT form online.

- Use the ‘Get Form’ button to access the TR-579-WT form and open it in your preferred online editor.

- In Part A, enter the legal name of the company. This must be the official registered name that appears on tax documents.

- Indicate the return types that apply by marking the corresponding checkbox for NYS-1 and/or NYS-45.

- An authorized officer or employee of the company must complete Part A by providing the declaration of authorization, ensuring they will have examined the withholding returns and certifying their accuracy.

- Provide the signature and date in the specified fields for the authorized employee or officer, along with their printed name and title.

- Move to Part B, where the electronic return originator (ERO) or paid preparer must declare the information accuracy based on company-provided data.

- In Part B, the ERO/paid preparer must sign and date the declaration to confirm the information is complete and true.

- Finally, save your changes. You can download, print, or share the completed TR-579-WT form as needed.

Complete your TR-579-WT form online today for a seamless e-filing experience.

Form TR-579-IT must be completed to authorize an ERO to e-file a personal income tax return and to transmit bank account information for the electronic funds withdrawal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.