Loading

Get Tiaa F11185 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TIAA F11185 online

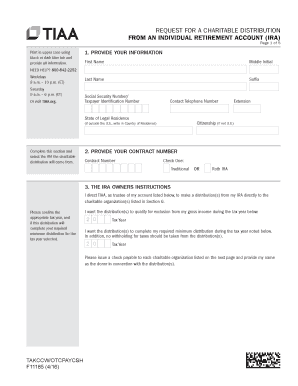

Filling out the TIAA F11185 form online for charitable distributions from an individual retirement account (IRA) can be straightforward. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your TIAA F11185 form.

- Click the ‘Get Form’ button to obtain the TIAA F11185 form and open it in your preferred online editor.

- Provide your information in the designated fields. Include your first name, middle initial, last name, suffix, social security number or taxpayer identification number, contact telephone number, state of legal residence, and citizenship status.

- Next, provide your contract number and select whether your IRA is a traditional or Roth IRA.

- In the IRA owner's instructions section, confirm the tax year for distribution and indicate whether this distribution will complete your required minimum distribution.

- Choose the amount to distribute from investments. You can either request a specific dollar amount from all available investments or specify amounts or percentages from individual accounts.

- Sign the form. Make sure to acknowledge that you are responsible for ensuring compliance with applicable tax laws and that you have provided a current mailing address to charitable organizations.

- List the charitable organizations you wish to distribute funds to, providing their names, addresses, and the amount for each check.

- Finally, save your changes, and once completed, download or print the form for your records.

Complete your TIAA F11185 form online today to ensure a smooth charitable distribution process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes. Although you cannot make QCDs to your donor-advised fund account during your lifetime, you can donate traditional IRA, 401(k), and some other tax-deferred assets to a donor-advised fund account upon death by way of a beneficiary designation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.