Loading

Get Death Benefits Trust Instruction Form - Thomson Snell And Passmore

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Death Benefits Trust Instruction Form - Thomson Snell And Passmore online

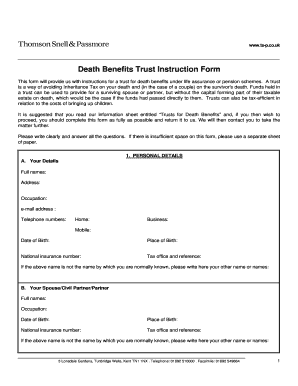

The Death Benefits Trust Instruction Form is essential for setting up a trust for death benefits under life assurance or pension schemes. This guide will help you navigate the form step-by-step, ensuring that you complete it accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with section 1 titled 'Personal Details'. Enter your full name, address, occupation, email address, and telephone numbers (home, business, and mobile) in the provided fields. Ensure this information is accurate, as it identifies you in the trust documentation.

- Provide your date and place of birth, and your National Insurance number as well as the tax office and reference. If you have any other names that you are known by, include them in the specified area.

- Next, fill out subsection 'B' regarding your spouse, civil partner, or partner. Include their full name, occupation, date and place of birth, National Insurance number, and any other names they may be known by.

- In subsection 'C', list your children, including those from any previous relationships. Provide their full names, addresses (if different from your own), and ages. If you do not have children, you can leave this section blank unless you want to make provision for future children.

- Proceed to section 2 titled 'Details of Death Benefits'. Here, you need to specify the names of your insurance or pension providers and their corresponding policy numbers. Include estimates of the death benefits derived from life assurance and pension schemes for yourself and your spouse/partner.

- Complete the information regarding any joint life assurances and the estimated values of occupational and personal pensions. Be thorough and accurate in this section.

- In section 3, you'll identify the trustees for the trust. You can either appoint yourself, your spouse/civil partner/partner, or other individuals. Mark one box to indicate your choice and provide their full names and addresses.

- Choose a name for the trust. By default, it will follow a format like 'The [Your Name] Death Benefits Trust'. If you wish for a different name, specify it accurately.

- Indicate the type of trust you desire. The form will default to a Discretionary Trust unless otherwise specified. If you prefer a different trust structure, provide those details.

- Outline the beneficiaries of the trust. Mark one box to select whether you want to restrict beneficiaries to your spouse/civil partner/partner and children or include others. Write the full names, addresses, and their relationship to you for any additional beneficiaries.

- Finally, sign and date the form where indicated, ensuring that both you and your spouse/civil partner/partner sign it if applicable. Once completed, save your changes, and you can download, print, or share the form as needed.

Complete your documents online for a smooth and efficient process.

A legal concept referred to as the “rule against perpetuities” prevents a trust from remaining active indefinitely. California law requires a trust to terminate within 90 years or no later than 21 years after the death of an individual alive at the time the trust was created.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.