Loading

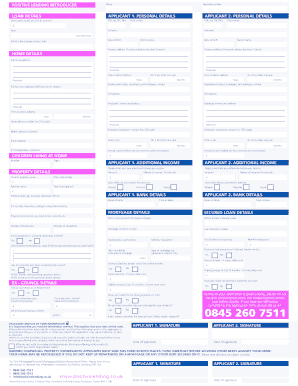

Get Secured Loan Application Form - Positive Lending - Positivelending Co

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Secured Loan Application Form - Positive Lending - Positivelending Co online

Filling out the Secured Loan Application Form online can be a straightforward process when you understand each component. This guide provides step-by-step instructions to help you complete the form with confidence.

Follow the steps to successfully complete the loan application form.

- Click ‘Get Form’ button to access the Secured Loan Application Form and open it in your preferred browser.

- Begin filling out the personal details for both applicants. Start with Title, First names, Surname, and Date of birth for each applicant. Ensure that all information is accurate.

- In the Loan Details section, indicate the amount you wish to borrow and specify the loan term in months or years. Provide the purpose of your loan as required.

- Fill in the Home Details, including your full home address and postcode. If you have lived at this address for less than three years, provide your previous address.

- Enter Employment Status for both applicants, detailing occupation, employer’s name and address, and time at the above employment. Include contact details for employers.

- If applicable, detail any children living at home by providing their number and ages.

- Complete the Additional Income section, listing any extra income for both applicants and specify the nature of this income.

- Proceed to the Property Details section, filling in the current property value, property type, number of bedrooms, and any relevant construction details.

- In the Mortgage Details section, provide information about your current mortgage company, mortgage account number, and any outstanding balances. Answer all questions regarding previous council ownership and arrears.

- Review the Disclosure and Use of Your Information section. Confirm that you understand how your data will be used, and indicate whether you wish to receive additional offers.

- Ensure both applicants provide their signatures in the designated areas, along with the dates of signing.

- Finally, review the entire form for completeness and accuracy. Save your changes, and choose to download, print, or share the completed Secured Loan Application Form as needed.

Start completing your Secured Loan Application Form online today!

Secured loans require collateral, like a car or home, while unsecured loans do not. Lenders may offer lower interest rates and larger borrowing limits on secured loans. Common examples of secured loans are auto loans, mortgages and business financing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.