Loading

Get Form W-8ben (rev. December 2000) - State Controller's

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8BEN (Rev. December 2000) - State Controller's online

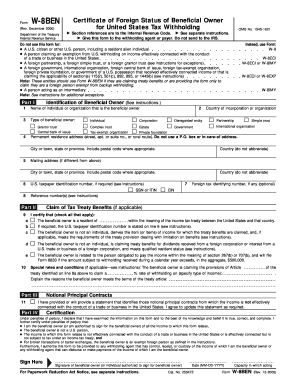

The Form W-8BEN is a certificate used by foreign individuals and entities to certify their foreign status for U.S. tax withholding purposes. This guide provides a step-by-step approach to successfully complete and submit the form online, ensuring compliance with applicable tax regulations.

Follow the steps to fill out the Form W-8BEN online easily and accurately.

- Click ‘Get Form’ button to access the form in an editable format.

- Enter the name of the individual or organization that is the beneficial owner in the designated field.

- Select the type of beneficial owner from the provided options, such as individual, corporation, or partnership.

- Supply the permanent residence address, including street, city, and country, ensuring no P.O. box is used.

- If applicable, fill in the mailing address that differs from the permanent address, along with the corresponding city and country.

- Provide your U.S. taxpayer identification number if required, such as a Social Security Number or Individual Taxpayer Identification Number.

- Enter your foreign tax identifying number if you have one; this field is optional.

- Complete the section for claim of tax treaty benefits, including the country of residence and details regarding the terms of the treaty.

- Certify your statements by checking the appropriate boxes that confirm your status and eligibility as the beneficial owner.

- Sign and date the form to validate the information provided, ensuring that it is accurate and complete.

- Once completed, save changes, and download the form. You may also print or share it as necessary.

Start filling out your Form W-8BEN online now to ensure compliance with U.S. tax regulations.

Who Must Provide Form W-8BEN. You must give Form W-8BEN to the withholding agent or payer if you are a nonresident alien who is the beneficial owner of an amount subject to withholding, or if you are an account holder of an FFI documenting yourself as a nonresident alien.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.