Loading

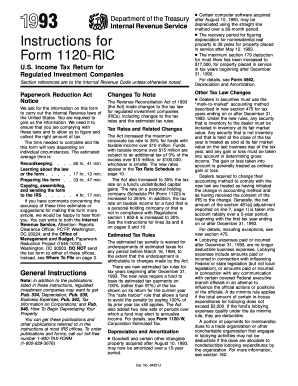

Get 1993 Inst 1120ric. Instructions For Form 1120 Ric

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1993 Inst 1120RIC. Instructions For Form 1120 RIC online

This guide provides a comprehensive overview of how to fill out the 1993 Inst 1120RIC, the U.S. Income Tax Return for Regulated Investment Companies. Users will find clear, step-by-step instructions on each section and field of the form, tailored to accommodate individuals with varying levels of experience.

Follow the steps to successfully complete Form 1120 RIC.

- Click the ‘Get Form’ button to access the 1993 Inst 1120RIC and open it in your editor.

- Review the general instructions section. This provides essential information about filing requirements and deadlines for your regulated investment company.

- Complete Item B on the form, indicating the date your fund was established. Enter the incorporation date of your regulated investment company.

- Input your employer identification number (EIN) in Item C. If you do not have one, apply using Form SS-4.

- For Item D, state your fund's total assets at the end of the tax year based on your accounting records.

- Select if this is a final return, change of address, or amended return in Item E.

- Move to Part I and start filling out the Investment Company Taxable Income section, beginning with reporting dividends, interest, and any capital gains.

- In Part II, calculate any tax on undistributed net capital gains, as necessary.

- Review the tax computation and fill out Schedule A for deductions related to dividends paid.

- Finalize any attachments, such as Form 2438 for undistributed capital gains, and ensure complete and accurate information is filled in.

- Once all sections are completed, save changes, download, or print the form as needed.

Ensure compliance by completing Form 1120 RIC online with attention to detail.

The election is made by computing taxable income as a RIC on Form 1120-RIC. Qualified opportunity funds. To certify as a qualified opportunity fund (QOF), the RIC must file Form 1120-RIC and attach Form 8996, even if the RIC had no income or expenses to report. See Schedule K, Question 15.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.