Loading

Get Form Fin 56: First Time Home Buyers' Exemption Claim Year End ... - Sbr Gov Bc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FIN 56: First Time Home Buyers' Exemption Claim Year End online

Filling out the Form FIN 56 is an essential step for first-time home buyers looking to claim an exemption. This guide will help you navigate through the process with clear, step-by-step instructions to complete the form efficiently.

Follow the steps to successfully complete and submit your exemption claim.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

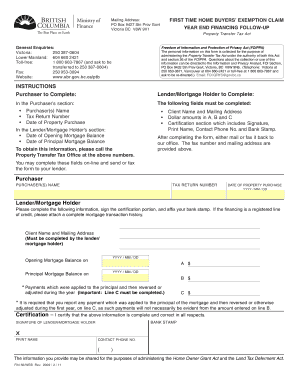

- In the Purchaser's section, provide your name, tax return number, and the date of property purchase formatted as YYYY/MM/DD. Ensure all information is accurate.

- In the Lender/Mortgage Holder's section, complete the fields for the opening mortgage balance and principal mortgage balance, noting the corresponding dates.

- In the dollar amounts section (A, B, C), carefully report any payments applied to the principal that were reversed or adjusted during the year. This is crucial for accurate reporting.

- Complete the certification section, including signature, printed name, contact phone number, and affixing your bank stamp.

- Once all fields are filled out correctly, you can save changes, download, print, or share the form for submission to the appropriate office via mail or fax.

Don't delay! Complete your Form FIN 56 online today to ensure your exemption claim is processed smoothly.

New home buyers can apply for a rebate of up to a maximum of 36% of the tax if the purchase price is $350,000 or less. A partial GST rebate is available for new homes costing between $350,000 and $450,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.