Loading

Get No Br-1010b 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

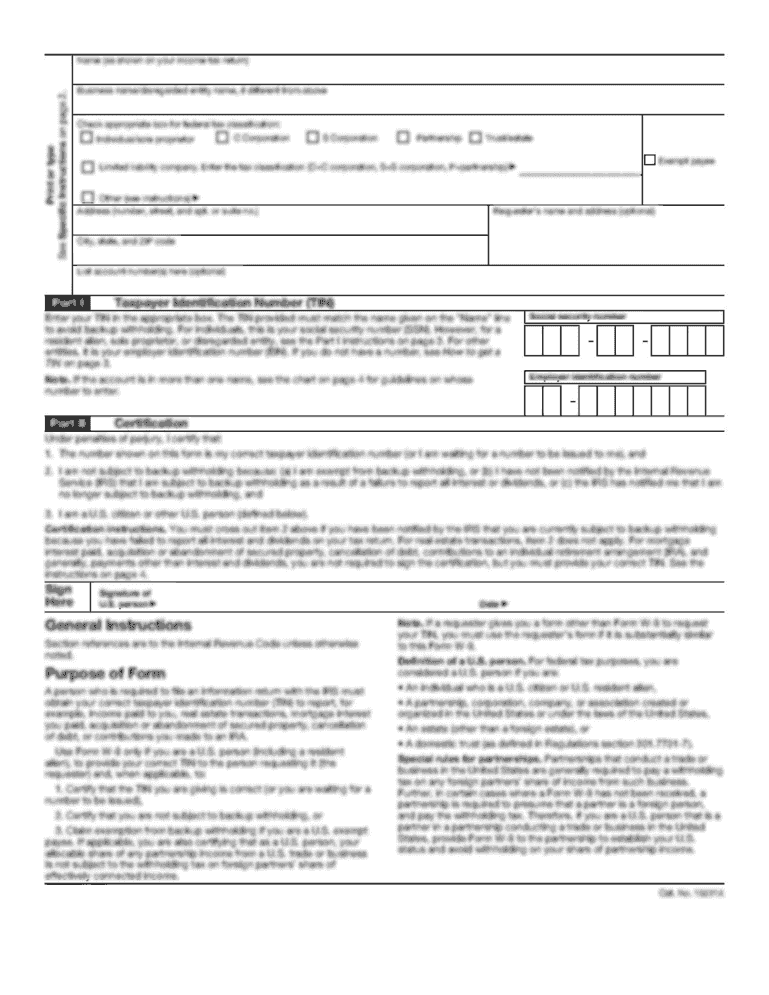

How to fill out the NO BR-1010B online

Filling out the NO BR-1010B form online is essential for businesses seeking registration across various Norwegian registers. This guide offers step-by-step instructions to ensure that users complete the form accurately and efficiently, regardless of their experience level.

Follow the steps to successfully complete the NO BR-1010B form online.

- Press the ‘Get Form’ button to obtain the document and open it in your browser.

- Fill in Section 1 by providing the complete name of your entity, its organizational number, and any new name if applicable. Make sure you complete all required fields for proper identification.

- In Section 2, indicate the nature of your filing, whether it concerns a new entity, amendments, or dissolution. Select the appropriate options for your situation.

- For Section 3, answer questions regarding whether the entity needs to be registered in additional registers, including the Business Register, and if it is subject to value-added tax regulations.

- Complete Section 4 by filling in the headquarters address. Ensure that this information is accurate, including postal code and contact details.

- In Section 5, provide the mailing address for correspondence. Double-check to confirm this is correct to receive important notices.

- Section 6 is for the business address only if different from the headquarters. Fill this in accurately if applicable.

- Input relevant details in Section 7 about the sender, including name and address, as this person will receive feedback on the submission.

- For Section 8, specify the organizational form if registering a new entity, selecting the appropriate box from the options provided.

- Step through Sections 9-26, filling out fields accurately according to the nature of your filing. Provide detailed descriptions of your business activities and any capital information if necessary: this may require additional attachments.

- Complete Section 27 by entering the notification address for the public authorities, ensuring it is up-to-date for notifications regarding your registration.

- Finally, review all sections for accuracy, then proceed to save changes, download the completed form, print it, or share it as needed.

Start filling out the NO BR-1010B form online today to ensure your business registration is accurate and timely.

A notice of filing report of no distribution confirms that a business has made no distributions during the tax year. This documentation can be essential for certain IRS requirements. By including it alongside the NO BR-1010B form, you can maintain transparency with the IRS. The US Legal Forms platform can help you generate this notice easily and accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.