Get Nl Ib 92 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NL IB 92 form online

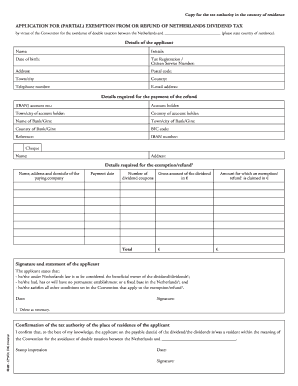

Filling out the NL IB 92 form online is a vital step in applying for a partial exemption from or refund of Dutch dividend tax. This guide provides clear, step-by-step instructions tailored for users of all legal backgrounds to ensure a smooth application process.

Follow the steps to successfully complete the NL IB 92 form online.

- Use the ‘Get Form’ button to access the NL IB 92 form and open it in an online editor.

- Begin by filling in the 'Details of the applicant' section. Enter your full name, initials, date of birth, tax registration or citizen service number, address, postal code, town or city, country, telephone number, and email address.

- Complete the 'Details required for the payment of the refund' section. Provide your IBAN account number, account holder's name, town or city of the account holder, country of the account holder, name of the bank or giro, town or city of the bank or giro, country of the bank or giro, BIC code, and reference number.

- Fill out the 'Details required for the exemption/refund' section. Include the name, address, and domicile of the paying company, the payment date, the number of dividend coupons, the gross amount of the dividends in euros, and the amount for which an exemption or refund is claimed.

- In the 'Signature and statement of the applicant' section, affirm that you meet the necessary conditions under Netherlands law, including beneficial ownership of the dividends and absence of a permanent establishment in the Netherlands. Enter the date and sign the form.

- If applicable, ensure the tax authority of your country of residence confirms the applicant's residency status in the designated section at the end of the form.

- Once all sections are completed, review your entries for accuracy. Users can save changes, download, print, or share the form as needed.

Start filling out the NL IB 92 form online today for a straightforward application process.

To fill out a Global Blue form, begin by providing your personal information, such as your name, address, and passport number. Next, detail the goods purchased and include any proof of payment. Lastly, submit the completed NL IB 92 Form along with your receipts, ensuring you have everything in order for a smooth refund process. Following these steps can help you manage your tax refunds effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.