Loading

Get Irs 8990 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8990 online

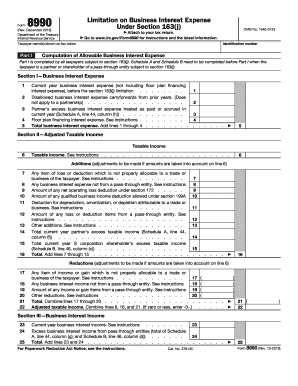

Filling out the IRS 8990 form can be a straightforward process when you follow the right steps. This guide provides clear instructions to help you complete the form accurately and efficiently, ensuring that you meet the requirements for reporting limits on business interest expenses.

Follow the steps to successfully fill out the IRS 8990 form online.

- Click the ‘Get Form’ button to access the IRS 8990 form and open it in your online document editor.

- Begin with Part I, where you will report your current year business interest expense. Enter the total on line 1, excluding any floor plan financing interest.

- Input any disallowed business interest expense carryforwards from previous years on line 2. If you are a partner, include amounts treated as paid or accrued on line 3.

- For any floor plan financing interest expenses, record the total on line 4. Then, sum lines 1 through 4 and enter the total on line 5.

- Next, move to Section II for Adjusted Taxable Income. Enter your taxable income on line 6. Complete the necessary adjustments for any additions or reductions as instructed.

- For Section III, input any current year business interest income on line 23. Include excess business interest income from pass-through entities on line 24.

- In Section IV, calculate the limitation on business interest expense by multiplying the adjusted taxable income from line 22 by 30%. Continue to complete lines 27 and 28, and sum these calculations on line 29.

- Determine the disallowed business interest expense by subtracting line 29 from line 5. Enter this on line 30, which provides the total current year business interest expense deduction.

- If you are part of a partnership or an S corporation, complete Parts II and III accordingly, following the instructions provided for each section.

- After entering all the required information, you can save your changes, download the form, print, or share it as needed.

Start filling out your IRS 8990 form online today for accurate business expense reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To complete IRS form 8990, begin by carefully reading the instructions provided by the IRS. Gather all relevant financial data, including your business's interest expenses and taxable income. Accurately fill out each section, ensuring that your calculations are correct, and that you attach any necessary schedules to fully support your claims.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.