Loading

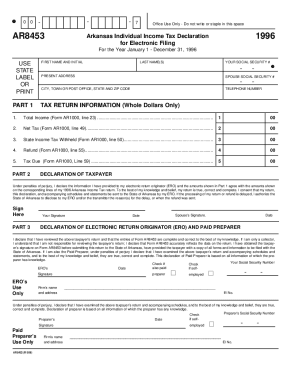

Get Total Income (form Ar1000, Line 23)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Total Income (Form AR1000, Line 23) online

Completing your Total Income on Form AR1000, Line 23 is an essential part of your tax filing process. This guide provides clear and supportive instructions to help you accurately fill out this section online, ensuring you meet all requirements efficiently.

Follow the steps to accurately complete your Total Income form online.

- Press the ‘Get Form’ button to access the Total Income form and open it in your editing tool.

- Locate Line 23 on the form, labeled Total Income. This line requires a whole dollar amount, reflecting your total income for the year.

- Gather all relevant income documents, such as W-2s, 1099s, and any other income statements. Ensure that you sum all of these amounts accurately.

- Input the total income amount you calculated from your documents into Line 23 of the form.

- Review the entered information carefully for any errors or discrepancies. Confirm that the amount reported matches your income documentation.

- After verifying that all entries are correct, save your changes. You will have the option to download, print, or share the completed form as needed.

Start completing your Total Income form online today!

AR1000F Full Year Resident Individual Income Tax Return (Instructions) AR1000NR Part Year or Non-Resident Individual Income Tax Return (Instructions)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.