Loading

Get Form 2742, T-1069 Local Unit Denial Of Homestead Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2742, T-1069 Local Unit Denial Of Homestead Exemption online

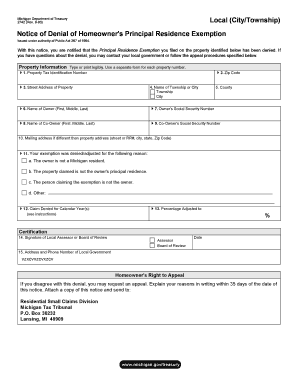

The Form 2742, T-1069 Local Unit Denial Of Homestead Exemption is essential for notifying property owners about the denial of their exemption. This guide will walk you through the process of completing this form online, ensuring a smooth submission process.

Follow the steps to fill out the Form 2742 online

- Click ‘Get Form’ button to access the form and open it for editing.

- Enter the property tax identification number in the designated field. Ensure this number matches the one on the original affidavit.

- Provide the complete street address of the property in the appropriate fields and indicate whether it is located in a city or township.

- Fill in the county name corresponding to the property location.

- Input the legal owner's full name and social security number. If there is a co-owner, include their information as well.

- If the mailing address differs from the property address, enter it in the specified field.

- Select the reason for the denial of the principal residence exemption by checking the appropriate box. If the reason is not listed, select ‘other’ and provide a detailed explanation.

- List all calendar years for which the exemption has been denied, keeping in mind that you can deny the current year and up to three preceding years.

- Indicate the percentage adjustment of the principal residence exemption, if applicable.

- The form must be signed by the local assessor or secretary of the board of review. Ensure you indicate who has signed the form.

- Enter the date of signing. This date starts the 35-day period for the homeowner to appeal the denial.

- Provide the contact address and phone number of the local government representative responsible for the denial.

- Review all entries for accuracy and save your changes. You may then download, print, or share the completed form as needed.

Take action now and start completing the necessary documents online.

Complete the Michigan Form 2368 The affidavit has to be filed with our office on or before June 1st to be applied to the current tax year. If you file after June 1st, it will be effective starting the following year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.