Loading

Get Service Control Limited Form 4.25 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Service Control Limited Form 4.25 online

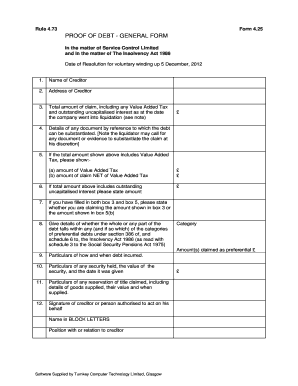

Filling out the Service Control Limited Form 4.25 online can appear complex, but with clear guidance, it becomes a manageable task. This form is essential for submitting a proof of debt in the matter of Service Control Limited under the Insolvency Act 1986.

Follow the steps to complete the form accurately and efficiently.

- Click 'Get Form' button to obtain the form and open it.

- In the first field, enter the name of the creditor. Ensure to use the full legal name as it appears in official documents.

- Next, provide the complete address of the creditor. This should include the street address, city, state, and zip code.

- In the total amount claim field, input the total sum owed, including any Value Added Tax. Make sure to be accurate as this amount is critical in the claim process.

- If your claim includes Value Added Tax, specify the amount in the designated VAT fields provided. This will help clarify the breakdown of your claim.

- If applicable, enter the amount of outstanding uncapitalised interest in the appropriate field. It is important to detail each component of your claim clearly.

- If you have filled out both box 3 and box 5, indicate whether you are claiming the total amount from box 3 or the net amount shown in box 5b. This will determine how your claim is processed.

- Provide details regarding preferential debts, if any, as noted in the insolvency guidelines. Be specific about the categories under which your debt qualifies.

- Outline the particulars of how the debt was incurred, including a timeline of events leading up to the claim.

- Include any particulars of security held against the debt, detailing its value and the date it was provided.

- If applicable, give details of any reservation of title claimed, specifying the goods supplied, their value, and when they were delivered.

- Finally, sign the form either personally or by an authorized representative. Clearly print the name in block letters and indicate your position in relation to the creditor.

- Once all fields are completed, be sure to save your changes, download the document, print it, or share it as needed.

Begin filing your Service Control Limited Form 4.25 online today to ensure a smooth claims process.

What Can Trigger a Gift or Estate Tax Audit? Here are some of the common factors that can lead to gift or estate tax audits: Total estate and gift value: Generally speaking, gift and estate tax returns are more likely to be audited when there are taxes owed and the size of the transaction or estate is relatively large.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.