Loading

Get Form 451 Brealb And Personal Bpropertyb - Douglas County Assessor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

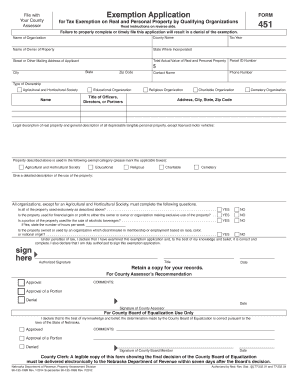

How to fill out the Form 451 for real and personal property tax exemption - Douglas County Assessor online

This guide provides detailed instructions for users on how to successfully fill out the Form 451 for tax exemption on real and personal property by qualifying organizations in Douglas County. Follow these steps carefully to ensure your application is completed correctly.

Follow the steps to fill out the form online.

- Click ‘Get Form’ button to download the Form 451 and open it in your editor.

- Fill out the 'Tax Year' section, indicating the year for which you are applying for an exemption.

- Enter the 'Name of Organization' that owns the property, followed by the county name and the name of the owner of the property.

- Specify the 'State Where Incorporated' and complete the 'Total Actual Value of Real and Personal Property' field.

- Provide the 'Street or Other Mailing Address of Applicant', followed by the 'Parcel ID Number' associated with the property.

- Fill in contact details, including the phone number and contact name for correspondence regarding this application.

- Indicate the 'Type of Ownership' by selecting the appropriate category that best describes your organization, which may include educational, religious, or charitable organizations.

- Provide the full legal description of the real property and describe all depreciable tangible personal property, except for licensed motor vehicles.

- Mark the boxes corresponding to the exempt category in which the property is used, such as agricultural or educational.

- Answer the questions about the exclusive use of the property and if it is used for financial gain, sale of alcoholic beverages, or discrimination.

- Sign and date the application, declaring that the information provided is correct to the best of your knowledge. Ensure that the authorized person signs the form.

- Retain a copy for your records and submit the form as per the provided instructions, which may include saving, downloading, printing, or emailing the application.

Complete your application for tax exemption online to ensure your organization's eligibility.

Under current law, if a business has less than $7,300 of personal property that would be listed on a single personal property schedule, then the personal property is exempt from the property tax and the business is not required to submit a schedule to the county assessor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.