Loading

Get Ghana Dt 0107

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ghana DT 0107 online

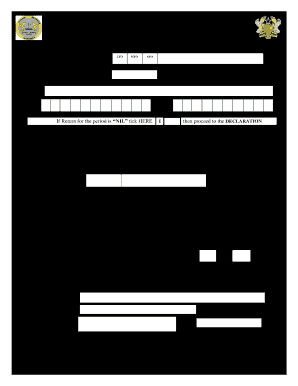

The Ghana DT 0107 form is essential for reporting monthly Pay As You Earn (PAYE) deductions. This guide provides detailed, step-by-step instructions to help users efficiently complete the form online.

Follow the steps to accurately complete the Ghana DT 0107 form.

- Press the ‘Get Form’ button to access the DT 0107 form and open it in your preferred editing platform.

- Indicate the current tax office by selecting the appropriate option (LTO, MTO, or STO) from the options provided.

- Input the period for the return in the format mm/yyyy, specifying the month and year applicable to this submission.

- Enter the name of the employer in the designated field.

- Fill in the new Tax Identification Number (TIN), which should be an 11-digit number, in the corresponding field.

- If applicable, include the old TIN of the employer, ensuring it is a 10-digit number.

- If there were no business transactions during the period, tick the box indicating a NIL return. Remember to complete the declaration section to submit the form even with a NIL response.

- In the summary section, classify the staff into categories: expatriate/management and others (senior, junior, and casual staff). Provide the number of staff for each category.

- Report the total cash emolument, which includes the basic salary and any cash allowances, for each staff category.

- Enter the total tax deducted for each staff category.

- Summarize the total tax deducted across all categories.

- Fill out the staff movement section, detailing the number of staff at the beginning of the month, those newly engaged, those disengaged, and the total number of staff at the end of the month.

- Indicate whether there are any other withholding tax obligations for the month by selecting 'Yes' or 'No'. If 'Yes', ensure to file the appropriate withholding tax return.

- In the declaration section, provide the name, designation, and signature of the declarant, and include the date of submission.

- Once all fields have been accurately filled out, save the changes, and you may then download, print, or share the completed form as necessary.

Complete the Ghana DT 0107 form online today to ensure timely submission of your PAYE deductions.

Related links form

Getting a Ghana VPN requires selecting a reputable VPN provider that offers Ghanaian servers. After choosing a provider, download their software and install it on your device. Once installed, choose a Ghanaian server location and connect. A VPN can help protect your online privacy while allowing access to Ghanaian content as specified by Ghana DT 0107.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.