Loading

Get Form 3210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3210 online

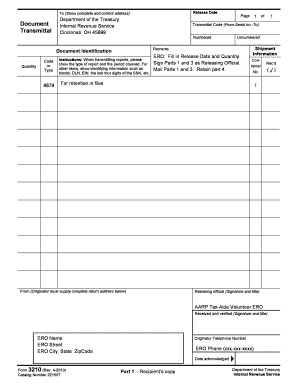

Filling out Form 3210 online can streamline your document management process, making it efficient and straightforward. This guide will walk you through each section of the form, ensuring that you provide all the necessary information accurately.

Follow the steps to successfully complete Form 3210 online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the release date in the designated field. This date is crucial as it signifies when the document will be transmitted.

- Fill in the quantity of documents being transmitted. Clearly state the number of items related to the report.

- Provide the transmittal code by selecting either numbered or unnumbered in the appropriate section.

- Indicate the code or type of document being transmitted. For example, input '8879' in the relevant area.

- In the remarks section, include any necessary identifying information such as blocks, DLN, EIN, or the last four digits of the SSN.

- Complete the information under the 'From' section by entering the complete return address of the originator.

- Ensure to sign Parts 1 and 3 as the releasing official and include your title.

- Review all filled sections for completeness and accuracy.

- Finalize your submission by saving changes, then download, print, or share the form as needed.

Complete your documentation process efficiently by filling out Form 3210 online today!

Form 3520 itself does not necessarily trigger an audit, but it does report specific transactions that can raise IRS scrutiny. The IRS examines forms for accuracy and consistency with overall income reporting. If you file Form 3520 incorrectly or unusually, it may lead to further investigation. For guidance on proper filing practices, check out the resources available at US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.