Loading

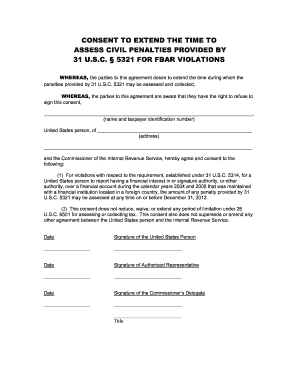

Get Consent To Extend The Time To Assess Civil Penalties Provided For Fbar Violations 2012-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consent to Extend the Time to Assess Civil Penalties Provided for FBAR Violations online

Filling out the Consent to Extend the Time to Assess Civil Penalties for FBAR violations is an important process for users wishing to manage their financial responsibilities effectively. This guide offers detailed steps to assist you in completing the form online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online tool for editing.

- Enter your full name and taxpayer identification number in the designated fields. Ensure this information is accurate as it identifies you within the IRS system.

- Provide your current address. It is crucial that the information here is up-to-date to facilitate communication from the IRS.

- Review the two statements included in the form. These sections clarify the implications of your consent regarding penalties for FBAR violations. Confirm you understand and agree with the statements.

- Date the form in the space provided. This indicates when you are signing the consent.

- Sign the form in the section labeled 'Signature of the United States Person'. If applicable, an authorized representative should sign under their designated section.

- If there is an authorized representative, have them date and sign in the appropriate fields.

- The final step is to ensure all required fields are completed and accurate. Review your entries before proceeding to save, download, print, or share the completed form as needed.

Complete your documents online with confidence.

The Foreign Account Tax Compliance Act (FATCA) has a statute of limitations of three years. This period starts after the filing date of the associated tax return. Understanding this timeframe is crucial to ensure compliance and avoid complications. By exploring the 'Consent to Extend the Time to Assess Civil Penalties Provided for FBAR Violations,' you can also enhance your understanding of related penalties and ensure timely action.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.