Loading

Get Ca New Business Application - Oakland 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA New Business Application - Oakland online

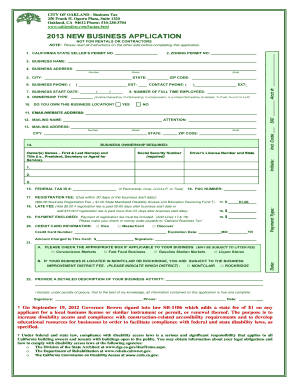

Filling out the CA New Business Application for Oakland online is an essential step in starting your business. This comprehensive guide will walk you through each component of the application process, ensuring that you complete it accurately and efficiently.

Follow the steps to complete your application with ease.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Enter your California State Seller’s Permit Number, which is mandatory for businesses involved in buying and selling activities.

- Provide your Zoning Clearance Number, ensuring it is obtained from the Building Services Department if your business is based in Oakland.

- Input your Business Name (Doing Business As). If you are not using a fictitious name, enter your full legal name.

- Fill in your Business Address with a complete street address—avoid using a PO Box.

- Specify the City, State, and Zip Code where your business operates.

- Enter your Business Phone Number as well as a Contact or Cell Phone Number.

- Indicate your Business Start Date; if you are outside Oakland, provide the date you began business activities in the city.

- State the Number of Full-Time Employees, excluding owners.

- Select the appropriate Ownership Type (options include Sole Ownership, Partnership, Corporation, LLC/LLP, or Trust).

- Clarify if you own your business location by checking ‘Yes’ or ‘No’.

- Provide an Email Address and/or Business Website. If you do not have an email, write ‘None’.

- Complete the Mailing Name and Attention fields.

- Fill in your current Mailing Address for receiving tax information.

- List the names of business owners, their titles, Social Security Numbers, and Driver’s License information.

- Enter the Federal Tax ID Number if applicable.

- Note the Initial Registration Fee, which must be paid upon processing your application.

- Calculate and enter your total payment amount, combining the registration and any late fees.

- If using a credit card, provide the necessary details including the amount to be charged.

- Check any applicable boxes for business classification that may incur additional fees.

- Provide a detailed description of your business activities.

- Sign and date the form to certify the accuracy of the information before submitting.

- Submit your completed application along with payment to the designated address.

Take the first step in your business journey by completing your CA New Business Application online today.

The State sets the sales tax in San Francisco at 8.625%. The City keeps 1% of the total sales tax revenue. The revenue from this tax goes into the City's General Fund budget.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.