Loading

Get Ny W-2 Correction Request 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY W-2 Correction Request online

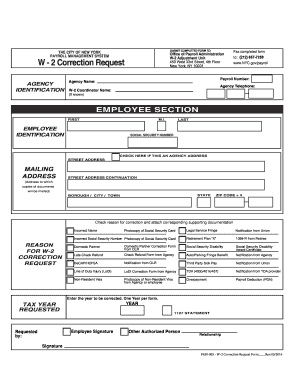

The NY W-2 Correction Request is an important document for correcting errors on your W-2 form. This guide provides clear, step-by-step instructions to help users navigate filling out the form online effectively.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter your payroll number in the designated field. This number is essential for identifying your agency's records.

- Provide the agency name in the appropriate section. This information helps to route the correction to the right department.

- Fill in the agency telephone number so that contact can be established if needed.

- If known, write down the W-2 coordinator's name. This person manages W-2 issues within your agency.

- In the employee section, input your first, middle initial, and last name. Make sure this information matches your official documents.

- Enter your Social Security number accurately to avoid further complications.

- If this is an agency address, check the corresponding box. If not, provide your street address and any additional address information.

- Specify your state, borough, city, or town, and complete your ZIP code plus four for full postal clarity.

- Select the reason for your W-2 correction. Ensure to attach the necessary supporting documentation as specified for each reason.

- Enter the tax year that requires correction. Note that only one year can be corrected per form.

- Sign the form in the employee signature section. If someone else is submitting the request, they should provide their relationship to you and their signature.

- Once you have completed the form, you can save the changes, download it, print the document, or share it as necessary.

Start completing your NY W-2 Correction Request online today.

To correct a Form W-2 with an incorrect SSN (and/or employee name), simply complete boxes a – i on Form W-2c. These boxes show what you previously reported for the employee's name and SSN as well as the corrections. You do not need to touch the federal, state, or local wage and tax boxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.