Loading

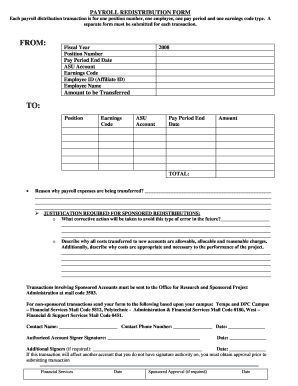

Get Each Payroll Distribution Transaction Is For One Position Number, One Employee, One Pay Period And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Each Payroll Distribution Transaction Is For One Position Number, One Employee, One Pay Period And online

This guide provides a clear and supportive framework for filling out the Each Payroll Distribution Transaction Is For One Position Number, One Employee, One Pay Period And form online. By following these steps, users will be able to accurately complete and submit their payroll distribution transactions with ease.

Follow the steps to accurately complete the payroll distribution form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Indicate the fiscal year for the transaction in the Fiscal Year field.

- Enter the Position Number associated with the payroll distribution in the Position Number field.

- Fill in the Pay Period End Date to specify the applicable pay period.

- Input the ASU Account related to this transaction in the ASU Account field.

- Select the appropriate Earnings Code for the type of earnings being processed.

- Provide the Employee ID (Affiliate ID) to identify the employee linked to this transaction.

- Enter the Employee Name in the corresponding field.

- Specify the Amount to be Transferred, indicating the total amount for the payroll distribution.

- Complete the necessary details regarding the reason for the payroll expenses transfer in the provided space.

- If applicable, provide justification for sponsored redistributions by detailing corrective actions and explaining the allowability of costs.

- Be sure to include any required signatures, contact name, and phone number in the designated fields.

- Once all fields are filled, save your changes. You can download, print, or share the completed form as needed.

Start completing your payroll distribution transaction form online today!

A pay period is the time interval that determines how often employees get paid. It can be weekly, biweekly, monthly, or any other frequency that the employer chooses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.