Loading

Get 2009-2010 Sub/unsub Loan Request Form Andrews University Student Financial Services Mail To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009-2010 Sub/Unsub Loan Request Form Andrews University Student Financial Services online

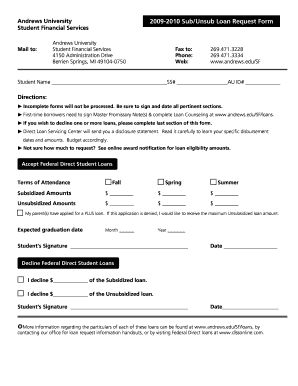

The 2009-2010 Sub/Unsub Loan Request Form is a critical document for students seeking federal student loans at Andrews University. This guide provides clear and step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to successfully complete the loan request form.

- Click the ‘Get Form’ button to download the loan request form and open it in your preferred application.

- Begin by entering your student name in the designated field directly at the top of the form. Ensure that your legal name is used to prevent any discrepancies.

- Enter your social security number (SS#) and Andrews University identification number (AU ID#) in the specified fields to help identify your record.

- In the ‘Accept Federal Direct Student Loans’ section, check the relevant terms of attendance: Fall, Spring, and/or Summer. Then, fill in the requested amounts for both subsidized and unsubsidized loans in the corresponding spaces.

- If your parent(s) have applied for a Parent Loan for Undergraduate Students (PLUS) loan, indicate this by checking the appropriate box. If the application is denied, you may wish to receive the maximum unsubsidized loan amount.

- Provide your expected graduation month and year to help the university determine your loan eligibility.

- Make sure to print and sign your name at the bottom of the form, along with the date. This ensures that your request is validated.

- If you wish to decline any portion of the loans, fill out that section as well by providing the amount of loan you wish to decline and signing as required.

- After completing the form, check for completeness and correctness. Save your changes and ensure you have a copy.

- Finally, submit the form by either mailing or faxing it to Andrews University Student Financial Services at the provided address or number.

Complete your loan request form online today to ensure timely processing of your financial aid.

Related links form

They don't. The only way the 7-year rule plays into your favor is if you file bankruptcy and it's been at least 7 years since you graduated. Otherwise, you must be enrolled in the RAP program to have any sort of relief from your payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.