Loading

Get State Form 49176 Form Nc 10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Form 49176 Form NC-10 online

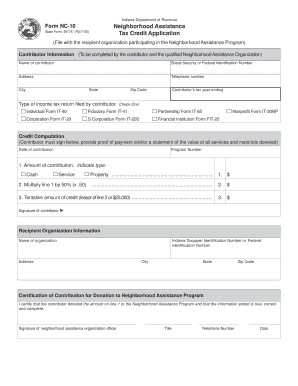

Filling out the State Form 49176 Form NC-10 online is a straightforward process that enables contributors to claim tax credits for contributions made to qualified organizations participating in the Neighborhood Assistance Program. This guide will provide you with a clear step-by-step approach to completing the form efficiently.

Follow the steps to complete the State Form 49176 Form NC-10 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the contributor information section. Enter the legal name of the contributor, and include the Social Security or Federal Identification Number along with the address, telephone number, city, state, and zip code.

- Indicate the type of income tax return filed by the contributor by checking the appropriate box. Be sure to also indicate the contributor's tax year ending date.

- For the credit computation section, enter the date of contribution and the program number. Detail the contribution amount and specify the type: cash, service, or property.

- Calculate the tentative amount of credit. Enter the amount of contribution multiplied by 50% in the second line. In the third line, indicate the lesser of this amount or $25,000.

- Ensure that the contributor signs the form to validate the application. Keep in mind that proof of payment, such as a copy of a check or receipt, must accompany the application.

- Complete the recipient organization information by entering the name and identification number of the organization. The organization's officer must certify the contribution by signing the designated section.

- Once you have filled in all required fields, review the form for completeness, save your changes, and then proceed to download, print, or share the form as necessary.

Complete your documents online today for efficient processing.

Related links form

The following individuals are required to file a 2020 North Carolina individual income tax return: Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020 for the individual's filing status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.