Get Untaxed Information Worksheet From 2011-2012 - Quinnipiac ... - Quinnipiac

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Untaxed Information Worksheet From 2011-2012 - Quinnipiac online

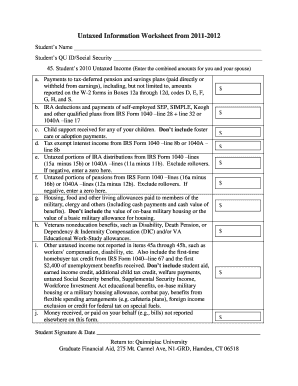

Completing the Untaxed Information Worksheet is an important step in providing accurate financial information to Quinnipiac University. This guide will walk you through the process of filling out the form online, ensuring you understand each component clearly.

Follow the steps to accurately complete the Untaxed Information Worksheet.

- Click the ‘Get Form’ button to access the worksheet in your browser. This action will allow you to view and edit the form as needed.

- Begin with the student's name field. Enter the full name of the student for whom the form is being filled out.

- In the student’s QU ID/Social Security field, enter the qualified university identification number or Social Security number associated with the student.

- For section 45, enter the amounts for each category of untaxed income. Start with 45a, where you report payments to tax-deferred pension and savings plans. Include amounts from your W-2 forms.

- Continue to 45b to input IRA deductions and payments of any qualified plans, referencing the appropriate lines on IRS Form 1040 or 1040A.

- In 45c, report child support received for your children, ensuring that foster care or adoption payments are excluded.

- Move to section 45d and provide tax-exempt interest income as indicated on IRS Form 1040 or 1040A.

- For 45e, enter untaxed portions of IRA distributions, again following the guidance on IRS forms, and ensure you exclude any rollovers.

- Fill in 45f with untaxed portions of pensions, referencing the appropriate lines from your IRS forms and remembering to exclude rollovers.

- In section 45g, enter housing and living allowances paid to certain professionals, excluding military housing value.

- For 45h, report any veterans noneducation benefits that apply, such as Disability or Dependency and Indemnity Compensation.

- In section 45i, include any other untaxed income, detailing specific types mentioned that do not fit the previous categories.

- Finally, in 45j, report any money received or paid on your behalf that has not been mentioned elsewhere in the form.

- After you have completed all relevant sections, sign and date the form in the provided area.

- Once all information is accurately filled in, you can choose to save your changes, download, print, or share the completed form as necessary.

Be sure to submit your completed Untaxed Information Worksheet online to ensure a smooth financial aid process.

No, the University of Maryland does not require the CSS Profile. They only require you to complete the FAFSA (Free Application for Federal Student Aid) for assessing financial needs. Does University of Maryland require the CSS Profile? | CollegeVine collegevine.com https://.collegevine.com › faq › does-university-of-... collegevine.com https://.collegevine.com › faq › does-university-of-...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.