Loading

Get Student Information Payment Information Department Information ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Student Information Payment Information Department Information form online

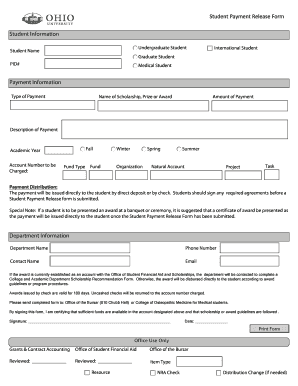

Filling out the Student Payment Release Form is essential for processing payments related to scholarships, prizes, or awards. This guide provides step-by-step instructions to help users complete the form accurately and efficiently, ensuring a smooth online submission process.

Follow the steps to complete the Student Payment Release Form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by completing the Student Information section. Indicate whether you are an undergraduate, graduate, international, or medical student. Provide your full name and PID#.

- In the Payment Information section, choose the type of payment. If applicable, enter the name of the scholarship, prize, or award, followed by the amount and description of payment.

- Select the academic term that pertains to the payment—Fall, Winter, Spring, or Summer. Specify the account number that will be charged and any relevant fund type, natural account, project, or task data.

- Note how the payment will be distributed—either via direct deposit or check. Ensure you sign any required agreements before submitting the form.

- Proceed to complete the Department Information portion. Input the department name, phone number, contact name, and email address.

- If the award is already established with the Office of Student Financial Aid and Scholarships, be aware that the department will need to complete a separate recommendation form.

- After filling out all sections, review the form for accuracy. Users can then save changes, download, print, or share the completed form as necessary.

Complete your Student Payment Release Form online for a hassle-free experience.

You can be charged all interest plus late payment fees, court fees and collection costs. You can be reported to credit bureaus and have your credit rating affected. The IRS may withhold your income tax refund and apply it to your loan balance. Up to 15% of your wages can be garnisheed to collect the debt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.