Loading

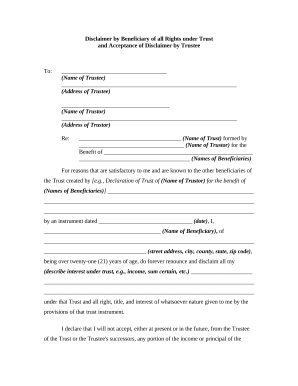

Get Ca Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee online

This guide provides a clear and comprehensive overview of how to complete the CA Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee form online. Whether you are familiar with legal processes or new to them, this step-by-step guidance will support you in successfully filling out the form.

Follow the steps to accurately fill out the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the name of the trustee in the designated field labeled 'Name of Trustee'.

- Enter the address of the trustee in the field labeled 'Address of Trustee'.

- Input the name of the trustor in the field labeled 'Name of Trustor'.

- Provide the address of the trustor in the corresponding 'Address of Trustor' field.

- Fill in the name of the trust in the section labeled 'Name of Trust'.

- In the next field, write the name(s) of the beneficiaries as outlined in the trust document.

- State the reason for the disclaimer, which should be satisfactory to you and communicated to other beneficiaries, in the designated text box.

- As the beneficiary, enter your name along with your complete address in the specified fields.

- Clearly describe the interest you are disclaiming under the trust (e.g., income or sum certain) in the designated area.

- Confirm that you will not accept any portion of the income or principal from the trust by checking the applicable box or including your declaration.

- Add your printed name and signature in the appropriate fields, ensuring to date the document.

- Complete the notary section by providing the date and having a notary public witness your signature.

- For the acknowledgement of receipt by the trustee, have the trustee fill in their name and signature, and complete the notary section as well.

- After filling out the form, save any changes made. You can then choose to download, print, or share the completed form.

Start completing your documents online with confidence today.

You can also disclaim an inheritance if you're the named beneficiary of a financial account or instrument, such as an individual retirement account (IRA), 401(k) or life insurance policy. Disclaiming means that you give up your right to receive the inheritance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.