Loading

Get Ny Dof-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DOF-1 online

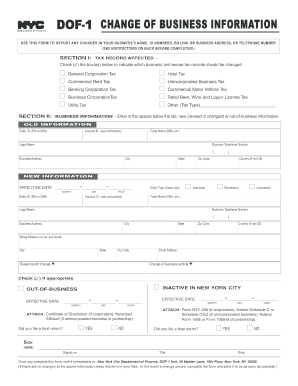

The NY DOF-1 form is essential for reporting changes in your business information to the Department of Finance. This guide provides clear, step-by-step instructions for completing the form online, ensuring your business records are accurate and up to date.

Follow the steps to accurately complete the NY DOF-1 form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editing platform.

- In Section I, review the list of tax records affected. Mark the box for each business tax record that requires updates. This will indicate which areas of your records need to be changed.

- Proceed to Section II, titled 'Business Information.' Here, you need to fill in both the old information and the new information for your business. Start with the old entity ID, legal name, trade name, and contact details.

- In the same section, enter the new or revised information in the appropriate fields. Make sure to include the effective date of the changes and any necessary identification numbers.

- If applicable, indicate your entity type by checking the appropriate box next to 'Individual,' 'Partnership,' or 'Corporation.' Ensure you provide clear and accurate details.

- Fill out the reason for the change, such as a change in business activity, name, or address. This helps the Department of Finance understand the context of your submission.

- Sign and date the form in the designated area, and provide your contact email address for any follow-up communications.

- Once you complete this form, you can save your changes, download the file, print a hard copy, or share it as needed. Finally, mail the completed form to the NYC Department of Finance.

Take action today to ensure your business information is accurate by completing the NY DOF-1 online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Class 1 property tax in NYC is levied on residential properties classified as Class 1, which include one- to three-family homes. The tax rate is generally lower than that of other property classes, making it advantageous for homeowners. Properly understanding the structure of Class 1 taxes helps ensure compliance, and the NY DOF-1 is a crucial tool in this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.