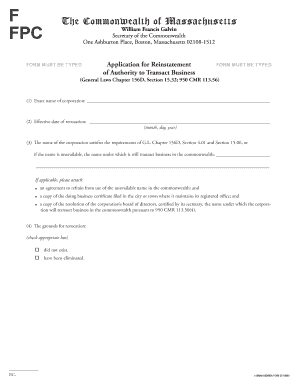

Get Of Authority To Transact Business

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Of Authority To Transact Business online

Filling out the Of Authority To Transact Business can be a straightforward process if you follow the correct steps. This guide offers step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Of Authority To Transact Business online.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred online editor.

- Begin by entering the exact name of the corporation in the designated field. Make sure this name matches the corporation's official documents.

- Next, indicate the effective date of revocation, using the format month, day, year to ensure clarity.

- Specify the name of the corporation that meets the requirements of General Laws Chapter 156D. If that name is unavailable, enter the name under which it will transact business in the commonwealth.

- If applicable, attach the required documents, including an agreement to refrain from using the unavailable name, a copy of the doing business certificate, and the corporation’s board resolution certified by its secretary.

- Indicate the grounds for revocation by checking the appropriate box that describes the situation: if the reason did not exist or if it has been eliminated.

- Fill in the required information about the foreign corporation certificate of registration, including the jurisdiction of incorporation and the date of incorporation.

- Provide the street addresses for both the principal office and the registered office in the commonwealth, including the city or town, state, and zip code.

- Enter the name of the registered agent in the commonwealth, ensuring they consent to their appointment.

- List the fiscal year end and provide a brief description of the corporation’s activities to be conducted in the commonwealth.

- Provide the names and business addresses of current officers and directors, ensuring that all entries are up to date.

- Attach any required certificates, such as a certificate of legal existence or good standing, and ensure that they are properly translated if in a foreign language.

- Include a certificate from the Massachusetts Department of Revenue stating that all corporate excise taxes and any related penalties have been paid.

- Select the appropriate box regarding the reinstatement by indicating whether it is without limitation or for a specified period.

- Finally, have an authorized individual sign the document and enter the date, ensuring that all signatures are in place.

- Once completed, you can download, print, or share the form as needed.

Start filling out your Of Authority To Transact Business form online today to streamline your business operations.

Certificate of authority number is issued by State to indicate that the business is authorized to collect sales taxes. Federal tax Id is issued by IRS for identification purposes. So, these are different numbers. Is certificate of authority number same as a Federal Tax I.D. number? justanswer.com https://.justanswer.com › tax › 0d5wl-certificate-aut... justanswer.com https://.justanswer.com › tax › 0d5wl-certificate-aut...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.