Loading

Get Ifta Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ifta Forms online

Filing the International Fuel Tax Agreement (IFTA) forms can seem daunting, but with the right guidance, it becomes a straightforward process. This guide provides clear instructions for filling out the IFTA Forms online, ensuring a smooth experience for all users.

Follow the steps to effectively complete your Ifta Forms online.

- Click ‘Get Form’ button to access the IFTA Form and open it in your preferred editor.

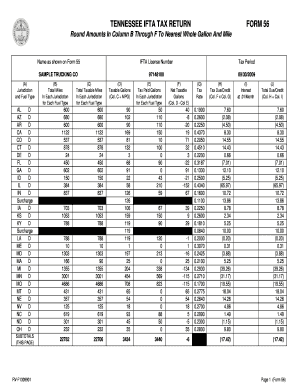

- Begin by entering your name exactly as it appears on Form 55. Be sure to include your IFTA license number, which is crucial for identification.

- Next, fill in the jurisdiction and fuel type for each state where fuel was purchased or miles were traveled. Each jurisdiction should be listed appropriately.

- Enter the total miles driven in each jurisdiction for the reporting period in the designated column.

- Calculate the total taxable miles for each jurisdiction and enter the figures in the corresponding field.

- Determine taxable gallons by dividing the taxable miles by your vehicle's miles per gallon (MPG) and input that data accordingly.

- In the next section, indicate the tax paid gallons for each jurisdiction.

- Calculate net taxable gallons by subtracting the tax paid gallons from the taxable gallons.

- Input the tax rate for each jurisdiction based on the applicable rates for the reporting period.

- Calculate the tax due or credit by multiplying the net taxable gallons by the tax rate.

- Finally, review the interest and total due/credit columns, ensuring all amounts are correct. Enter any interest applicable to the total due.

- After completing all sections, save your changes. You can then download, print, or share the form as needed.

Complete your Ifta Forms online today for a hassle-free filing experience.

Yes. You must file a completed IFTA return each quarter. Under the International Fuel Tax Agreement, you are required to file a tax return if you do not travel in any IFTA member jurisdictions or purchase any taxable fuel during the quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.