Loading

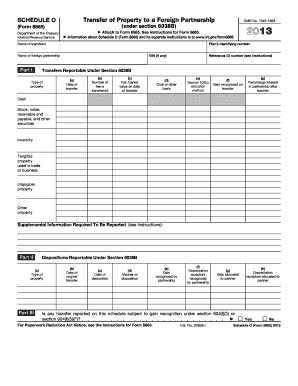

Get 2011 Form 8865 (schedule O) - Irs Ustreas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 8865 (Schedule O) - IRS Ustreas online

Filing the 2011 Form 8865 (Schedule O) can seem daunting, but with clear guidance, you can navigate the process smoothly. This guide provides step-by-step instructions to help you fill out the form online with confidence.

Follow the steps to fill out the 2011 Form 8865 (Schedule O) effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Identify the filer’s identifying number and enter the name of the transferor, including their Employer Identification Number (EIN) if applicable.

- Enter the name of the foreign partnership to which the property is being transferred. This is a crucial step for proper identification in the filing.

- Complete Part I, which requires detailed information on the type of property being transferred. Specify the date of transfer and record the number of items transferred, their fair market value on the transfer date, and the cost or other basis.

- Provide information about the Section 704(c) allocation method and any gain recognized on transfer, as well as the percentage interest in the partnership after the transfer.

- If relevant, fill in the depreciation recapture recognized by the partnership and any gain allocated to the partner, alongside any depreciation recapture allocated to the partner.

- Move to Part II to report dispositions. Indicate the type of property, date of original transfer, date of disposition, manner of disposition, and gain recognized by the partnership.

- Finally, check if any transfer reported on this schedule is subject to gain recognition under specific sections as indicated on the form.

- Once all fields are accurately completed, you can save your changes, download the document, print it, or share it as necessary.

Start filling out your Form 8865 (Schedule O) online today for a streamlined filing experience.

The Schedule G (Form 8865) Accessible is used by taxpayers who must report certain foreign or controlled foreign partnership transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.