Loading

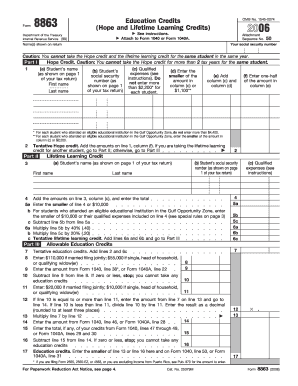

Get 2006 50 Name(s) Shown On Return Your Social Security Number Caution: You Cannot Take The Hope

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 50 Name(s) Shown On Return Your Social Security Number Caution: You Cannot Take The Hope online

This guide provides clear instructions for completing the 2006 50 Name(s) Shown On Return Your Social Security Number Caution: You Cannot Take The Hope form. By following these steps, you can ensure an accurate submission for claiming education credits efficiently and effectively.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- In the section titled 'Name(s) shown on return', enter the names of each student for whom you are claiming education credits, as they appear on the tax return.

- Proceed to Part I and for each student claiming the Hope credit, complete columns (a) through (f). Ensure that the student's qualified expenses do not exceed the maximum limit defined in the instructions. Use the provided worksheet if necessary to calculate these amounts accurately.

- Continue to Part II if claiming the Lifetime Learning credit for another student. Again, complete the required fields, ensuring you distinguish between credits taken for different students accurately.

- Review all entries for accuracy. After confirming that all information is correct, you can save your changes, download the form, print, or share it as necessary.

Complete your education credit form online today to maximize eligible deductions.

The Hope Credit, which was available from 1998 to 2008 for eligible students for the first 2 years of higher education, was expanded and renamed the American opportunity tax credit (AOTC) in 2009. The Hope Credit was a credit of up to $1,500 for eligible students for the first 2 years of college.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.