Loading

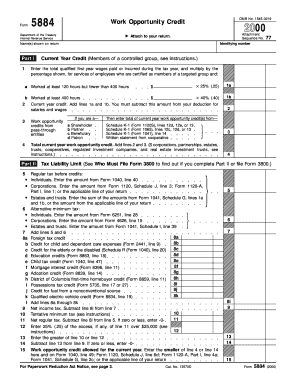

Get Form 5884 Work Opportunity Credit Attach To Your Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5884 Work Opportunity Credit Attach To Your Return online

Filling out Form 5884 is a crucial step for employers seeking to claim the Work Opportunity Credit for qualified first-year wages paid to targeted-group employees. This guide provides clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to complete the form online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name(s) shown on your tax return at the top of the form along with your identifying number.

- In Part I, line 1, enter the total qualified first-year wages paid to employees who are certified as members of a targeted group. For employees who worked at least 120 hours but fewer than 400 hours, multiply the wages by 25% and enter this amount on line 1a.

- For employees who worked at least 400 hours, multiply their wages by 40% and enter this amount on line 1b.

- Add the amounts from lines 1a and 1b and enter the total on line 2. Remember, you must reduce your deduction for salaries and wages by this amount.

- If applicable, enter the current year work opportunity credits from pass-through entities on line 3.

- Continue to Part II if necessary, to calculate your tax liability limit based on your regular tax and alternative minimum tax, following the specific instructions provided for each line.

- For each line that requires calculation or input of credits (lines 5 through 15), carefully follow the instructions provided to ensure accurate reporting.

- Once you have completed all relevant sections, review your entries for accuracy.

- Save your changes, and consider downloading, printing, or sharing the completed form as needed.

Complete your documents online to ensure you maximize your potential tax credits efficiently.

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.