Loading

Get Nh Form 5-re 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH Form 5-RE online

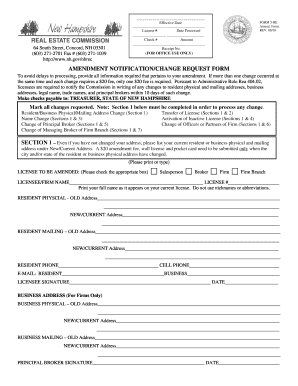

The NH Form 5-RE is an important document for notifying the New Hampshire Real Estate Commission of changes related to real estate licenses. This guide provides clear, step-by-step instructions to help you fill out this form online effectively.

Follow the steps to complete the NH Form 5-RE online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Section 1 requires you to fill in your current resident or business physical and mailing address under the 'New/Current Address' fields. Make sure to include any changes or mark them clearly, as this section must be completed to process your amendment.

- Indicate the license type you are amending by checking the appropriate box—Salesperson, Broker, Firm, or Firm Branch. Provide your full name as it appears on your current license, as well as your license number.

- Fill in the old and new addresses for both resident physical and mailing locations. Ensure accuracy to prevent any processing delays.

- Complete your contact information, including both resident and business email addresses and phone numbers.

- In the designated section, sign and date the form. Ensure that you are using your full legal signature as it appears on your existing licenses.

- If applicable, complete the necessary sections for license transfer, name change, activation of inactive status, or change of principal broker. Make sure to include any required supporting documents and fees as indicated in the form.

- Once you have entered all required information, review the form for accuracy and completeness before saving your changes. You have the option to download, print, or share the finalized form.

Complete your NH Form 5-RE online today for a hassle-free submission process!

Related links form

In New Hampshire, the approval process for an LLC typically takes about one week once you submit your Articles of Organization. However, for expedited service, you may opt for a faster processing option. To ensure your tax responsibilities are clear, you may want to download and complete the NH Form 5-RE at this time. This proactive approach can help you get started on the right foot.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.