Get Duplicate 1099/taxable Earnings Summary Release Form 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Duplicate 1099/Taxable Earnings Summary Release Form online

Completing the Duplicate 1099/Taxable Earnings Summary Release Form online can streamline the process of obtaining your necessary tax documents. This guide provides clear and concise instructions to help you accurately fill out the form with ease.

Follow the steps to fill out the Duplicate 1099/Taxable Earnings Summary Release Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

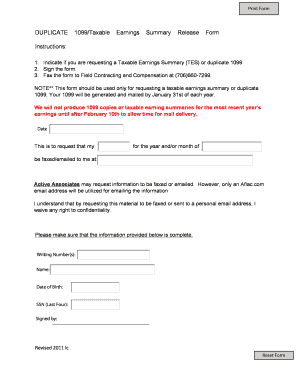

- Indicate whether you are requesting a Taxable Earnings Summary or a duplicate 1099 by selecting the appropriate option on the form.

- Enter the year and/or month for which you are requesting the documents in the designated field.

- Provide your contact information by filling in the section where you specify the fax number or email address where the documents should be sent.

- Complete the personal identification section with your writing number, full name, date of birth, and the last four digits of your Social Security Number.

- Sign the form in the provided area to authenticate your request.

- Once all fields are complete, you can save changes, download, print, or share the form as needed.

Take the next step in managing your documents by completing the Duplicate 1099/Taxable Earnings Summary Release Form online.

Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. Contributions to similar accounts, such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. This form must be mailed to participants and the IRS by May 31. What Is IRS Form 5498? - TurboTax Tax Tips & Videos - Intuit intuit.com https://turbotax.intuit.com › investments-and-taxes › wha... intuit.com https://turbotax.intuit.com › investments-and-taxes › wha...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.