Loading

Get Fl Cr2e006 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL CR2E006 online

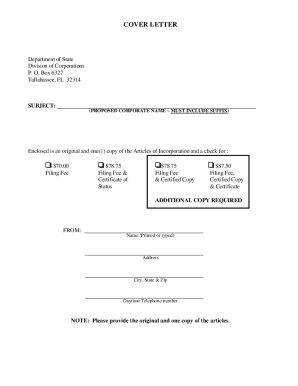

Filling out the FL CR2E006 is an essential step for establishing a not-for-profit corporation in Florida. This guide will help you navigate the components of the form and ensure that you complete it accurately and efficiently.

Follow the steps to successfully complete the FL CR2E006 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- In Article I, enter the name of your corporation, ensuring it includes an appropriate corporate suffix such as Corporation, Corp., Incorporated, or Inc. Remember, 'Company' or 'Co.' cannot be used.

- In Article II, provide the principal place of business and mailing address of your corporation. The principal address must be a street address; you may use a P.O. Box for the mailing address if it is different.

- In Article III, clearly state the specific purpose or purposes for which the corporation is organized. A vague statement such as 'any and all lawful business' will not meet the requirements.

- In Article IV, describe how the Directors are elected or appointed. Be specific about the process you intend to use.

- In Article V, list the names, addresses, and titles of at least three Directors. Include this information as providing it may be necessary for licenses or bank accounts.

- In Article VI, enter the name and Florida street address of the initial Registered Agent. This agent must sign and print or type their name below their signature to confirm their acceptance.

- In Article VII, provide the name and address of the Incorporator. This individual must also sign and print or type their name below their signature.

- If applicable, include an effective date as a separate article. Note that this date cannot be more than five business days prior to receipt or exceed ninety days after the filing date.

- Once all sections are completed, review the form for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Start completing the FL CR2E006 online to establish your not-for-profit corporation today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

FL tax collection allowance refers to the provisions that dictate how nonprofits can collect donations and manage tax-exempt status. Understanding these allowances ensures that nonprofits operate within legal boundaries while optimizing donation potential. The FL CR2E006 outlines these concepts clearly. For comprehensive guidance, platforms like uslegalforms can help navigate the complexities of tax regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.