Loading

Get General Filing Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the General Filing Requirements online

Filling out the General Filing Requirements form online can be a straightforward process if you follow the right steps. This guide will provide you with a comprehensive overview of the form and detailed instructions to assist you in completing it effectively.

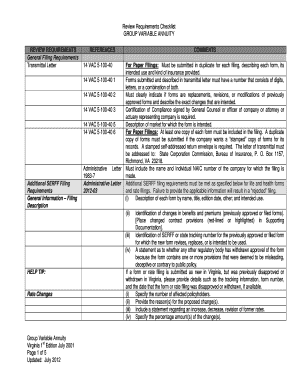

Follow the steps to complete the General Filing Requirements form online.

- Click the 'Get Form' button to obtain the General Filing Requirements form and open it in your browser.

- Begin by entering the name and address of the company in the designated fields. Ensure that the full corporate name appears correctly.

- Provide a description of each form being submitted, including its intended use and any relevant details. This information should be clear and concise.

- If applicable, indicate whether any forms are replacements, revisions, or modifications of previously approved forms, and describe the exact changes made.

- Include the certification of compliance signed by the general counsel, company officer, attorney, or actuary representing the company.

- Specify the market for which the form is intended, including the identification of changes in benefits and premiums as needed.

- Ensure that each form number appears in the lower left-hand corner of the first page, in compliance with the specified formatting requirements.

- Once all necessary fields are filled, review the form for accuracy and completeness before finalizing.

- After verification, you can save your changes, download, print, or share the completed form as needed.

Start filling out the General Filing Requirements online today for a smooth submission process.

Minimum Income to File Taxes in California IF your filing status is . . .AND at the end of 2022 you were* . . .THEN file a return if your gross income** was at least . . . Married filing separately any age $5 Head of household under 65 65 or older $19,400 $21,150 Qualifying widow(er) under 65 65 or older $25,900 $27,3002 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.