Loading

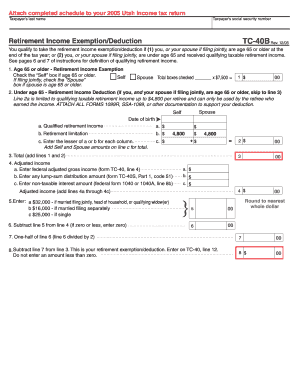

Get Print Form Attach Completed Schedule To Your 2005 Utah Income Tax Return Taxpayer 's Last Name

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Print Form Attach Completed Schedule To Your 2005 Utah Income Tax Return Taxpayer's Last Name online

This guide will help you navigate the Print Form Attach Completed Schedule To Your 2005 Utah Income Tax Return Taxpayer's Last Name. Follow these step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to successfully fill out your tax form.

- Click ‘Get Form’ button to initiate the process of obtaining the form and open it in the designated editor.

- Enter the taxpayer's last name in the appropriate field at the top of the form. This identifies the individual responsible for the tax return.

- Input the taxpayer's social security number in the designated area. Ensure accuracy to avoid any issues with processing.

- For retirement income exemption, determine if you or your spouse is 65 or older by checking the corresponding box for 'Self' or 'Spouse'.

- If you and your spouse are under 65, complete line 2a with qualifying taxable retirement income and include any necessary documentation, such as Forms 1099R or SSA-1099.

- Calculate totals by following the instructions provided for lines 1, 2, and 3 to ensure accurate deductions are recorded.

- On lines 4-6, enter your federal adjusted gross income and calculate the adjusted income based on the guidelines set in the form.

- Complete line 8 with your retirement exemption/deduction, remembering to avoid entering an amount less than zero.

- After verifying that all sections are filled out accurately, save your changes, download the completed form, print it, or share it as needed.

Begin completing your tax documents online today for a smooth filing process.

Every C corporation incorporated in Utah (domestic), qualified in Utah (foreign), or doing business in Utah, whether qualified or not, must file a corporate franchise tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.