Loading

Get 2003 Tc-40b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 TC-40B online

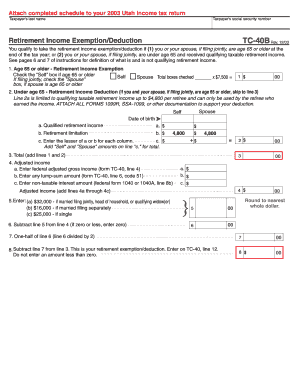

The 2003 TC-40B form allows individuals to claim a retirement income exemption or deduction on their Utah income tax return. This guide will walk you through each section of the form, ensuring that you have a clear understanding of how to fill it out accurately online.

Follow the steps to complete your TC-40B form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer's last name in the designated field. This identifies your form properly.

- Next, input the taxpayer's social security number in the provided section. This number is crucial for tax identification.

- Indicate your eligibility for retirement income exemption or deduction. If you or your spouse is age 65 or older, check the 'Self' or 'Spouse' box accordingly.

- If you or your spouse is under age 65, fill out line 2a with the qualifying taxable retirement income up to $4,800. Ensure to attach all supporting documentation such as forms 1099R or SSA-1099.

- Record the lesser amount from sections 2a and 2b into section 2c for both 'Self' and 'Spouse'. Add these amounts for your total.

- Proceed to line 3 and calculate the total by adding the values from lines 1 and 2.

- For adjusted income, refer to your federal adjusted gross income from form TC-40 and enter it in line 4a, then enter any lump-sum amounts in line 4b, followed by any non-taxable interest in line 4c.

- Add the amounts from lines 4a, 4b, and 4c to find your adjusted income.

- On line 5, enter the appropriate amount based on your filing status. Subtract this from your adjusted income in line 6.

- Divide the result from line 6 by 2 and enter it on line 7.

- Finally, subtract line 7 from line 3 and enter the result in line 8 as your retirement exemption or deduction. Ensure it is not less than zero.

- Once completed, save your changes, download, print, or share the form as needed.

Complete your TC-40B form online today to ensure you claim your retirement benefits accurately.

A "nonresident" is any individual who does not meet the definition of a resident. ( Sec. 59-10-103(1)(g), Utah Code Ann. ) Nonresidents are subject to the Utah personal income tax, but only on the portion of state taxable income derived from Utah sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.